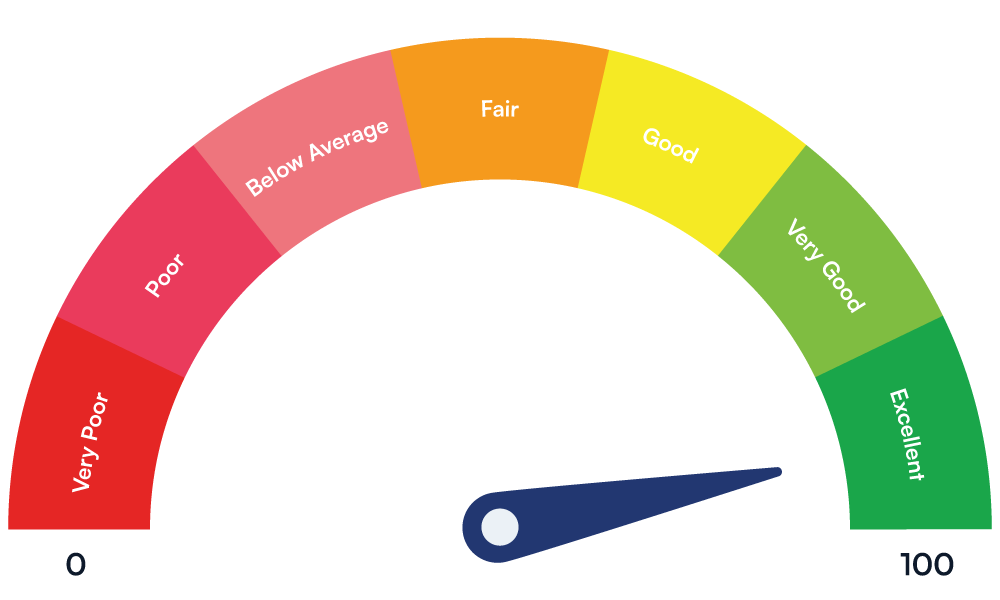

What Is A Credit Score?

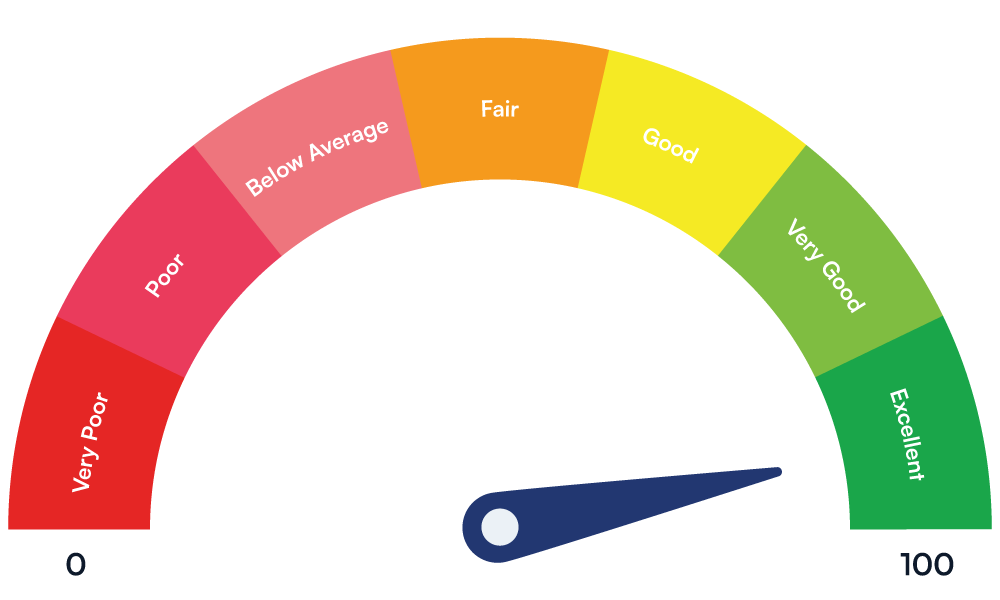

A credit score is a score that gives you a snapshot of your credit health. It evaluates your financial history to determine if you are creditworthy. It serves as a good indication of whether credit providers will approve your credit product applications. Just like how you need a resume when applying for a job, you also need a comprehensive financial health check-up before applying for credits/loans.

Having a good credit score will open up more financing options for you, as more credit providers will be willing to work with you. Additionally, they may offer you better rates for credit products such as home, car, and personal credits/loans. Conversely, a less than satisfactory credit score may discourage credit providers from granting you a credit / loan.

What is be Credit Positive

“Be credit positive” refers to maintaining a positive credit history and credit score. Having a positive credit rating indicates responsible financial behavior which makes you a low risk for credit providers when borrowing money or obtaining credit.

Keeping A Low Credit Utilization

Maintaining a mix of credit

Regularly checking your credit report

Avoiding excessive credit applications

Paying your bills on time

Factors to be Credit Positive

Paying your bills on time

Keeping A Low Credit Utilization

Maintaining a mix of credit

Avoiding excessive credit applications

Regularly checking your credit report

How to Build A Good Credit History

1

Pay your credit card

bills on time

2

Avoid applying for or

having too many credit

cards simultaneously

3

Use your credit

card responsibly

4

Review your credit reports

on a regular basis

5

Pay off your purchase

within six months if you

are using a credit card

6

If you are facing

financial difficulties,

seek professional help

7

Think of your cashflow

when considering

a credit / loan

8

To exist in CCRIS you

will need to apply for

a loan/credit card

Ideal Reports, Simplified.

Select the perfect plan that aligns with your financial goals and aspirations. We offer a variety of plans tailored to suit your specific needs, whether you’re an individual looking to monitor your credit score or a business/company aiming to access comprehensive financial data.

INDIVIDUAL

MyScore

For individuals who want to assess their financial health.

What You’ll Get

- Individual Credit Score

- Banking Information (CCRIS)

- Trade Reference Information

- Litigation Information

Download a MySCoRE Credit

Report sample here.

BUSINESS/COMPANY

MyBizScore

For entrepreneurs who want to identify potential risks and take steps to mitigate them.

What You’ll Get

- SME Credit Score

- SSM Registry & up to 5 Years of Financial Statement

- Shareholding/Directorship

- Banking Information (CCRIS)

- Trade Reference Information

- Litigation Information

Download a MyBizScore Credit

Report sample here.

Ideal Reports, Simplified.

Select the perfect plan that aligns with your financial goals and aspirations. We offer a variety of plans tailored to suit your specific needs, whether you’re an individual looking to monitor your credit score or a business/company aiming to access comprehensive financial data.