What is a credit report?

A credit report is a detailed report which contains your credit activity and credit history prepared by a credit bureau. Most credit providers use this report for the loan assessment and to determine loan applicants’ credit worthiness.

What is the purpose of MySCoRE report?

MySCoRE report is your personal report which provides a comprehensive overview of your current credit standing, credit activitiy, enabling you to easily monitor your credit behavior.

What information can I find in MySCoRE report?

MySCoRE report contains personal information, individual credit score, rating on the probability of default, as well as detailed and summary information of CCRIS banking. You may also find details of legal actions and other trade/credit transaction information in the report.

What are the sources of information for MySCoRE report?

Credit Bureau Malaysia Sdn Bhd (CBM) collects information from various sources, including but not limited to:

- National Registration Department (NRD)

- Bank Negara CCRIS (Central Credit Reference Information System)

- Companies Commission Malaysia (CCM)

- Publications of legal proceedings and notices in newspapers and government gazettes

- Trade Credit Reference information

How can I get MySCoRE report?

To obtain MySCoRE report, log in to creditbureau.com.my and follow the steps outlined on the website.

How often can I request MySCoRE report?

There is no limit to the number of times you can request your report. However, please note that updated CCRIS information will only be reflected on 15th of each month.

Are there any circumstances where I can access MySCoRE report for free?

For the latest promotions, do swing by our website – we keep it updated just for you!

Does Credit Bureau Malaysia Sdn Bhd (CBM) decide whether to approve my loans and credit applications?

No. The credit provider shall decide on the approval or rejection for your loan applications. Our report is only used as one of the point of reference for them to decide on the application status.

My bankers told me the application has been rejected due to an issue with my credit report. Why?

If the credit provider mentions this, you may need to purchase your own credit report to further check the reported information. There may be information in the report which may need your attention.

I found out that the information in MySCoRE report is wrong. What can I do?

You may contact us at helpdesk@creditbureau.com.my and request for an update. The officer in charge may require the necessary proof of settlements or conclusions i.e. letter of discharge, settlement, court order striking off the case etc.

Can I dispute information on MySCoRE report if I believe it is inaccurate?

Yes, you can raise your concern by emailing us at helpdesk@creditbureau.com.my for further assistance.

What should I do if I suspect fraudulent activity or errors on MySCoRE report?

If you suspect fraud or notice errors, promptly contact our helpdesk via email at helpdesk@creditbureau.com.my.

I was rejected by one financial institution. Will the others do the same?

Every credit provider has different risk appetites and follow different sets of lending policies. You may approach another credit provider for further information.

Can I prevent Credit Reporting agencies from keeping information about me?

Credit Reporting Agencies may collect and process your information in accordance with the applicable laws, regulations and regulatory requirements.

How long will the record stay in my credit report if I have settled my debt?

For legal records, they will be kept for 2 years with the latest status. Settled credit facilities with the credit providers will not be displayed in MySCoRE report.

What are the benefits of having MySCoRE score?

You will be able to see and monitor your credit activity as well as to check if there is any inaccurate information on you.

How is MySCoRE calculated?

There are several factors are taken into account for the score calculation, such as payment history, amount owed, length of credit history, and new credit with different weightage.

What is considered a good credit score in MySCoRE report?

A good credit score in MyScore report depends on both the Credit Score and Probability of Default. Generally, individuals with higher Credit Scores and lower Probability of Default are considered to have good credit standing. It indicates a lower credit risk and reflects responsible credit behavior. However, specific score ranges may vary, and it’s essential to monitor your credit score regularly to stay informed about your credit health.

What factors can negatively impact my credit score in MySCoRE report?

Various factors can negatively affect your credit score, such as late or missed payments, high credit utilization, limited credit history, frequent credit inquiries, and negative information like collections or public records. Practicing responsible credit management is crucial to maintaining a healthy credit score.

How long does negative information stay on MySCoRE report?

The duration varies depending on the type of negative information.

How can I improve MySCoRE?

It is advisable to make on-time payments over time. Avoid delaying payments and always be in contact with your bankers if there is an issue with your repayment.

Will MySCoRE change over time?

Yes, additional information or changes in information will affect the score.

How long does it take for updates or corrections to reflect on MySCoRE report?

We will process your request to update information with the relevant parties. However, it will usually take around 7-14 working days for the change to be reflective in your report.

Is Trade Reference legal in MySCoRE report?

Trade Credit Reference is a non-bank trade information provided by CBM’s subscribers/members, mostly due to defaulted payments in a trade transaction. It is legal so long as it is used to the extent not prohibited by the applicable laws, regulations and regulatory requirements.

Will it affect MySCoRE report if my name is listed in a Trade Reference record?

Trade Credit Information will not be taken into account for MySCoRE report. However, we advise maintaining good repayment behavior for a good credit standing, as credit providers will be able to view this information.

What should I do if I've settled the outstanding amount, but my name still appears in the report?

You may reach out to the respective trade referees and inquire about the updates. However, if there is no favorable response from them, kindly reach out to us for further checking.

What is the MyBizSCoRE report?

MyBiZSCoRE report is a company credit report with a credit score to get an overall view of a company’s credit standing. It includes detailed information on personal, bank credit, legal/bankruptcy, bank credit account, and trade credit reference information.

How do I get the MyBizSCoRE report?

As of now, you may email your request to helpdesk@creditbureau.com.my

My company loan is rejected by the bank due to an issue with the company's credit report. What does this mean?

There might be some details in the report which need your attention. Please note each credit provider will have their own set of rules and guidelines for credit applications.

What is the SMEs Credit Scoring Model, and how does it work?

The SMEs Credit Scoring Model is a system that assesses the creditworthiness of businesses and companies. It takes into account historical credit information and payment behavior, along with more recent data, to provide a comprehensive view of a subject’s credit risk. With the refined scoring model, there is an increase in the approval rate for subjects identified as low risk and a decrease in the NPL rate for those identified as high risk. This enhances the accuracy and efficiency of credit decision-making.

How does the model differ from previous credit assessment methods?

The newly refined model emphasizes a balance between historical and recent data to better reflect the current landscape, allowing for a more nuanced and accurate assessment of credit risk.

How does the model specifically identify low risk and high risk subjects?

The model uses a combination of credit history, payment behavior, and current financial data to classify subjects. Low risk subjects exhibit consistent payment behavior and strong financials, while high-risk subjects may have inconsistent payment histories and weaker financial positions.

What is the Probability of Default (PD)?

The Probability of Default (PD) is a metric provided by our system that indicates the likelihood of a subject defaulting on their obligations in the next 12 months. This allows businesses to make informed credit decisions by understanding the associated risks.

How is PD calculated?

PD is calculated using statistical models that take into account various factors, such as credit history, payment behavior, and current financial data, to predict the likelihood of default within a specific time frame.

Can PD be used to assess both individuals and businesses?

Yes, PD can be applied to both individual and corporate subjects, providing a versatile tool for assessing credit risk.

Can I subscribe to the company report on a monthly basis?

As of now, we do not offer such a service. However, you may drop us an email for the request, and it will be processed accordingly.

How does Credit Bureau Malaysia handle the security and privacy of my credit information?

As a regulated entity, the security and privacy of your data means a lot to us. We will not disclose your credit information without your consent.

Can I authorize someone else to access MySCoRE/MyBizSCoRE report on my behalf?

No, credit information is confidential and can only be accessed by the account holder. You may send us an email at helpdesk@creditbureau.com.my to enquire further for exceptional processing.

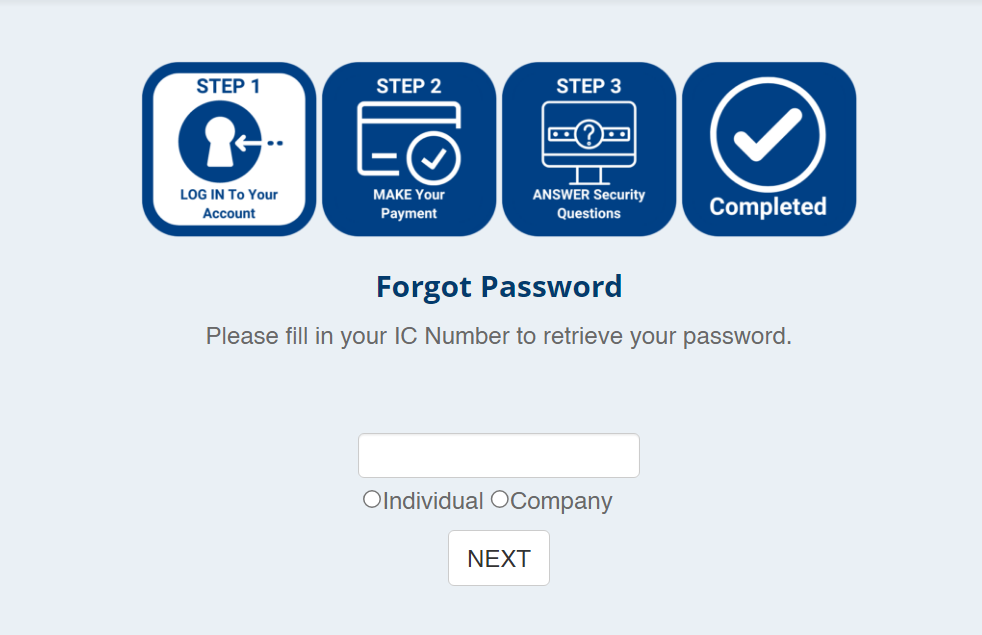

How do I change my password?

To reset your password, please follow the steps below:

- Navigate to the Credit Bureau Malaysia (CBM) website.

- Click on the “Get My Credit Report” button.

- Select the “Individual” option.

- Click on the “Reset Password” link.

How do I apply for a new user ID?

- For general users (GU), you may apply for a new ID via our website. Click on the registration link, fill in all the required information, and click “Submit.” Please contact your security administrator for application approval.

- For security administrators (SA), please email helpdesk@creditbureau.com.my for further assistance.

What information do I need to provide when applying for a new user ID?

When applying for a new user ID for Security Administrator account, you will need to fill up the Security Administrator registration form and provide a copy of your IC (front and back). However, for general users, registration can be done via our online portal without requiring any supporting documents.

What is the SMEs Credit Scoring Model, and how does it work?

The SMEs Credit Scoring Model is a system that assesses the creditworthiness of businesses and companies. It takes into account historical credit information and payment behavior, along with more recent data, to provide a comprehensive view of a subject’s credit risk. With the refined scoring model, there is an increase in the approval rate for subjects identified as low risk and a decrease in the NPL rate for those identified as high risk. This enhances the accuracy and efficiency of credit decision-making.

How does the model differ from previous credit assessment methods?

The newly refined model emphasizes a balance between historical and recent data to better reflect the current landscape, allowing for a more nuanced and accurate assessment of credit risk.

How does the model specifically identify low risk and high risk subjects?

The model uses a combination of credit history, payment behavior, and current financial data to classify subjects. Low risk subjects exhibit consistent payment behavior and strong financials, while high-risk subjects may have inconsistent payment histories and weaker financial positions.

What is the Probability of Default (PD)?

The Probability of Default (PD) is a metric provided by our system that indicates the likelihood of a subject defaulting on their obligations in the next 12 months. This allows businesses to make informed credit decisions by understanding the associated risks.

How is PD calculated?

PD is calculated using statistical models that take into account various factors, such as credit history, payment behavior, and current financial data, to predict the likelihood of default within a specific time frame.

Can PD be used to assess both individuals and businesses?

Yes, PD can be applied to both individual and corporate subjects, providing a versatile tool for assessing credit risk.

Is there a waiting period for new user ID approval?

For General User (GU), it will be dependant on the speed of which your security admin approve your application. For Security Administrator (SA), there is no waiting period.

How long does it typically take to process a new Security Administrator's registration?

The typical processing time for new Security Administrator’s registration is 1 working day.

Can I change my user ID after registration?

No, user IDs cannot be changed after registration.

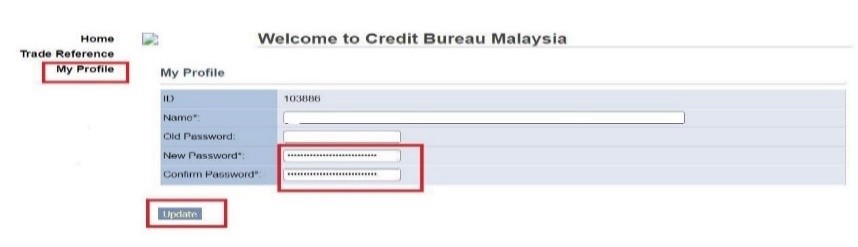

How do I change my password?

To change your password, follow these steps:

- Login to the Credit Bureau Malaysia.

- Click on “My Profile”.

- Change your password and click “Update”.

If my ID is locked, how can I reactivate it?

- For general users (GU), please contact your security administrator to reactivate your ID.

- For security administrators (SA), you may email helpdesk@creditbureau.com.my for further assistance.

I have forgotten my Security Question to log in. How can I reset the question?

In the event that you forget your Security Question and encounter difficulty logging in, please contact us via email at helpdesk@creditbureau.com.my.

I have forgotten my user ID. How do I retrieve it?

You may contact us via email at helpdesk@creditbureau.com.my.

How can I update my contact information in the website?

To update your contact information, simply log in to the website and access the ‘My Profile’ section to make the necessary changes.

Are there any fees associated with password reset or user ID retrieval services?

No, there are no fees associated with password reset or user ID retrieval services.

Can I have multiple user IDs associated with the same email address?

No, having multiple user IDs associated with the same email address is not allowed.

My staff/colleague has already resigned. How can I deactivate their ID?

- For general users (GU), the security administrator may proceed to deactivate their ID under the Security Administration option by changing the status from active to revoke.

- For security administrators (SA), please email helpdesk@creditbureau.com.my for further assistance.

If I find out there is a discrepancy in the credit report information, how do I rectify the issue?

You may email helpdesk@creditbureau.com.my with relevant supporting documents for further assistance.

I have not received the OTP as I recently changed my email address. How do I update the email?

You may contact your security administrator in order to update your new email.

After I purchase the report, how long will it take for me to receive it?

After purchase, you may retrieve the report from inbox. Please expect a longer period should the report be one that consists of “bulk data”.

How do I register as a new security administrator (SA)?

Go to Subscriber Access > Register > Download Security Administrator Profile Form. Fill out the application form and email it, along with a copy of your IC, to helpdesk@creditbureau.com.my for further assistance.

I would like to inquire about other reports/products. How do I proceed with this?

Drop us an email at helpdesk@creditbureau.com.my and we will get back to you as soon as possible!