Understanding one’s credit history is crucial for making more informed decisions about loans, mortgages, and other financial products. One essential tool in this regard is the Central Credit Reference Information System (CCRIS) information, which forms part of a comprehensive credit report. Managed by Bank Negara Malaysia, CCRIS collects and disseminates detailed information about a data subject’s credit and loan history with financial institutions in Malaysia, helping credit providers to assess the creditworthiness of potential borrowers.

Key Components of a CCRIS Report in a Credit Report

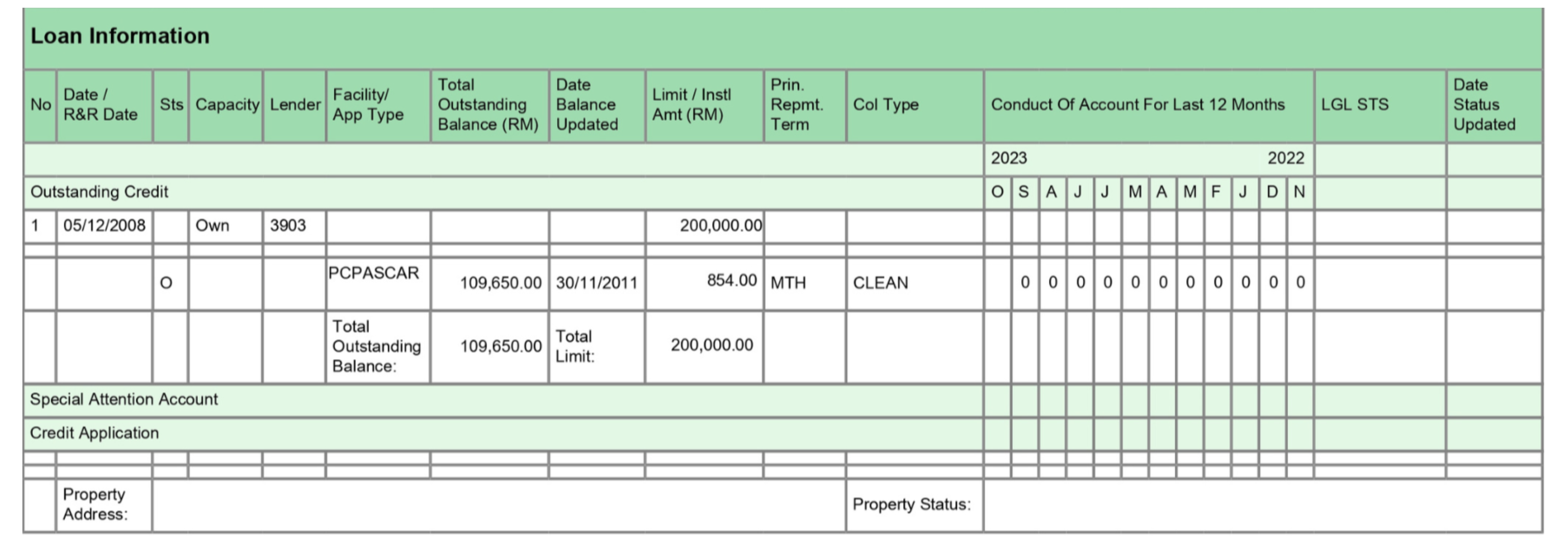

CCRIS information provides a snapshot of a data subject’s credit history with financial institutions in Malaysia and is an integral part of a comprehensive credit report. The picture above is a sample of how CCRIS information would look in a credit report. Below are the key components typically found in a CCRIS report:

- No: This is the serial number of the entry in the report.

- Date / R&R Date: The date when the loan or credit facility was reported or restructured and rescheduled (R&R).

- Sts: The status of the loan or credit facility, indicating if it is active, closed, or in default.

- Capacity: Indicates the role of the individual in the loan, such as borrower, guarantor, etc.

- Lender: The financial institution or lender that provided the loan or credit facility.

- Facility / App Type: The type of credit facility or application, such as personal loans, mortgages, or credit cards.

- Total Outstanding Balance (RM): The total amount of money currently owed on the loan or credit facility.

- Date Balance Updated: The date when the outstanding balance was last updated.

- Limit / Instl Amt (RM): The credit limit or the installment amount in Malaysian Ringgit.

- Prin. Repmt. Term: The principal repayment term, which indicates the period over which the principal amount is to be repaid.

- Col Type: The type of collateral, if any, associated with the loan or credit facility.

- Conduct Of Account For Last 12 Months: This section shows the payment history over the past 12 months. It indicates whether payments were made on time (‘0’) or were late (‘1’, ‘2’, etc., for one, two, or more months late respectively).

- LGL STS: The legal status, indicating if there are any legal actions or statuses associated with the account.

Importance of CCRIS Information in Credit Reports

CCRIS information is integral to the overall credit reporting system. Here’s how it relates to broader credit assessments:

- Creditworthiness Evaluation: Credit providers use CCRIS reports to evaluate a borrower’s creditworthiness. A clean payment history with ‘0’s indicates a responsible borrower, increasing the chances of loan approval.

- Loan Eligibility: The detailed information in CCRIS reports helps banks and financial institutions determine the eligibility of an applicant for various credit products. Late payments or outstanding balances can impact loan approval and interest rates.

- Financial Health Monitoring: For data subjects, regularly reviewing their CCRIS report helps in monitoring financial health. It allows them to ensure all information is accurate and to take corrective actions if there are any inaccuracies.

Understanding your CCRIS information is essential for maintaining good credit health and securing more favorable loan terms. It also aids in managing current finances and plays a crucial role in future financial planning and achieving long-term financial goals.

To get a comprehensive view of your credit score and detailed credit report, download the CBM+ app today and view your MySCoRE report today!