Do you really know

your customers?

Are you missing warning signs

about their financial health?

Are default payments

hurting your cash flow?

Introducing CBM CreditPro™

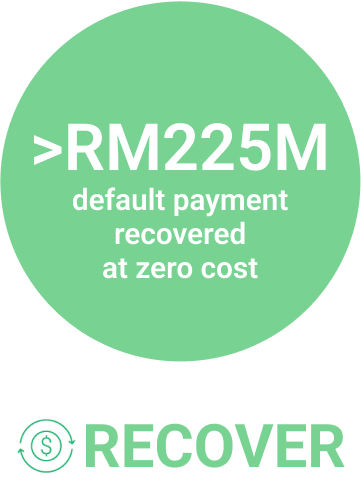

A comprehensive credit risk management platform trusted by leading banks, corporations, SMEs – built to assess customer and supplier credit risk, monitor credit behavior and improve debt recovery effort. Empowering your business with smarter credit decision and improved cash flow.

3 Ways CBM CreditPro™

Manages and Reduces Your

Business Credit Risk

Pricing Plan

Start From

*Terms & Conditions:

- All prices stated are subject to 8% SST and any applicable tax.

- The one (1) month complimentary is applicable exclusively to eligible new CBM CreditPro™ users.

- Upon expiry of the initial subscription period, all subsequent renewals shall be based on the standard twelve (12) months subscription period at the prevailing subscription fees, unless otherwise revised or agreed by Credit Bureau Malaysia (CBM).

- Fees for CBM CreditPro™ Standard and Premium subscription plans are waivable upon eligibility.

- Products and services included under each subscription plan are limited to those specified for the plan, including the Regular Reports (encompassing CBM database data, litigation data and trade reference data) and Standard Credit Monitoring Services. Any usage exceeding the limits included in the subscription plan, or any access of reports or services not included in the plan will incur additional charges, billed separately according to CBM’s prevailing fees.

- CBM reserves the right to vary, modify or terminate this promotion at any time at its sole discretion.

- Other terms & conditions apply.

Special Reports Available

Contact us

Submit your details now and our business consultants will contact you soon.

Inquiry Form

Frequently Asked Questions

What is CBM CreditPro™?

How does CBM CreditPro™ work?

What key benefits do CBM CreditPro™ offer for business?

How long does it take to generate a report?

How do I subscribe to CBM CreditPro™?