When applying for financial products in Malaysia, you might encounter terms like CCRIS and credit reports. These tools are essential for evaluating creditworthiness but serve different purposes and are managed differently. Here’s a comprehensive look at the differences between CCRIS and credit reports, and why they matter.

What is CCRIS?

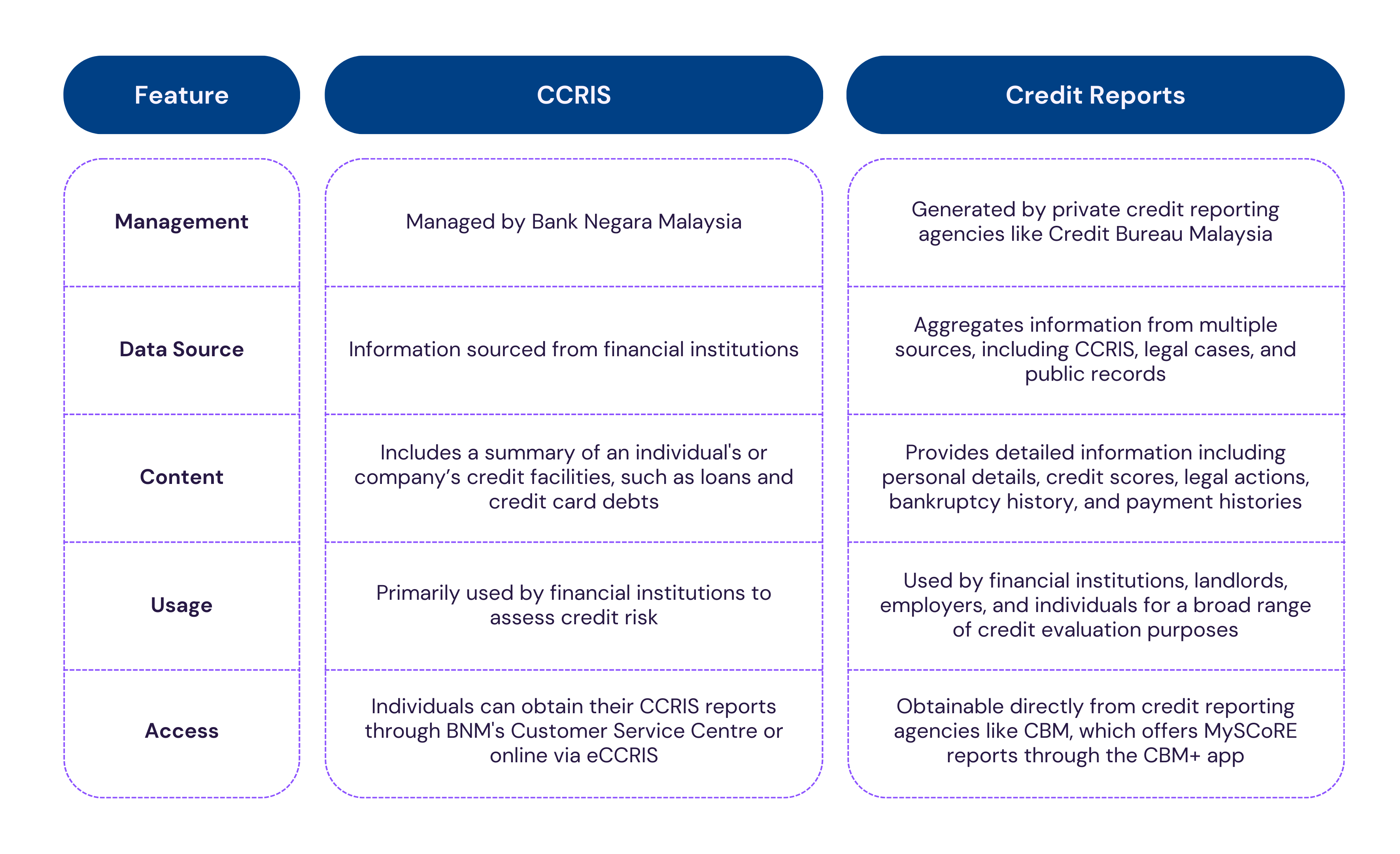

CCRIS, or the Central Credit Reference Information System, is managed by Bank Negara Malaysia (BNM). It gathers credit information from various financial institutions in Malaysia, including banks, insurance companies, and government agencies. The primary function of CCRIS is to collect and maintain credit-related data to help lenders assess the creditworthiness of borrowers.

What is a Credit Report?

Credit reports in Malaysia are produced by private credit reporting agencies such as Credit Bureau Malaysia (CBM). These reports compile information from various sources, including CCRIS data, legal cases, bankruptcy information, and trade references. Credit reports provide a more comprehensive view of an individual’s credit health.

Key Features and Differences Between CCRIS and Credit Reports

Both CCRIS and credit reports play integral roles in the financial ecosystem. While CCRIS provides a summary of your credit information from financial institutions, credit reports offer a broader, more detailed view. Understanding these tools can help you make better financial decisions and manage your credit more effectively.

Get Your MySCoRE Report Today!

Empower yourself with a comprehensive view of your credit health. Download the CBM+ app now to access your MySCoRE report and gain valuable insights into your financial standing today!