When you’re looking to secure financing or apply for credit in Malaysia, you might come across terms like “hard credit inquiry” and “soft credit inquiry.” But what do these really mean for you and your credit score? Let’s break it down in simple terms.

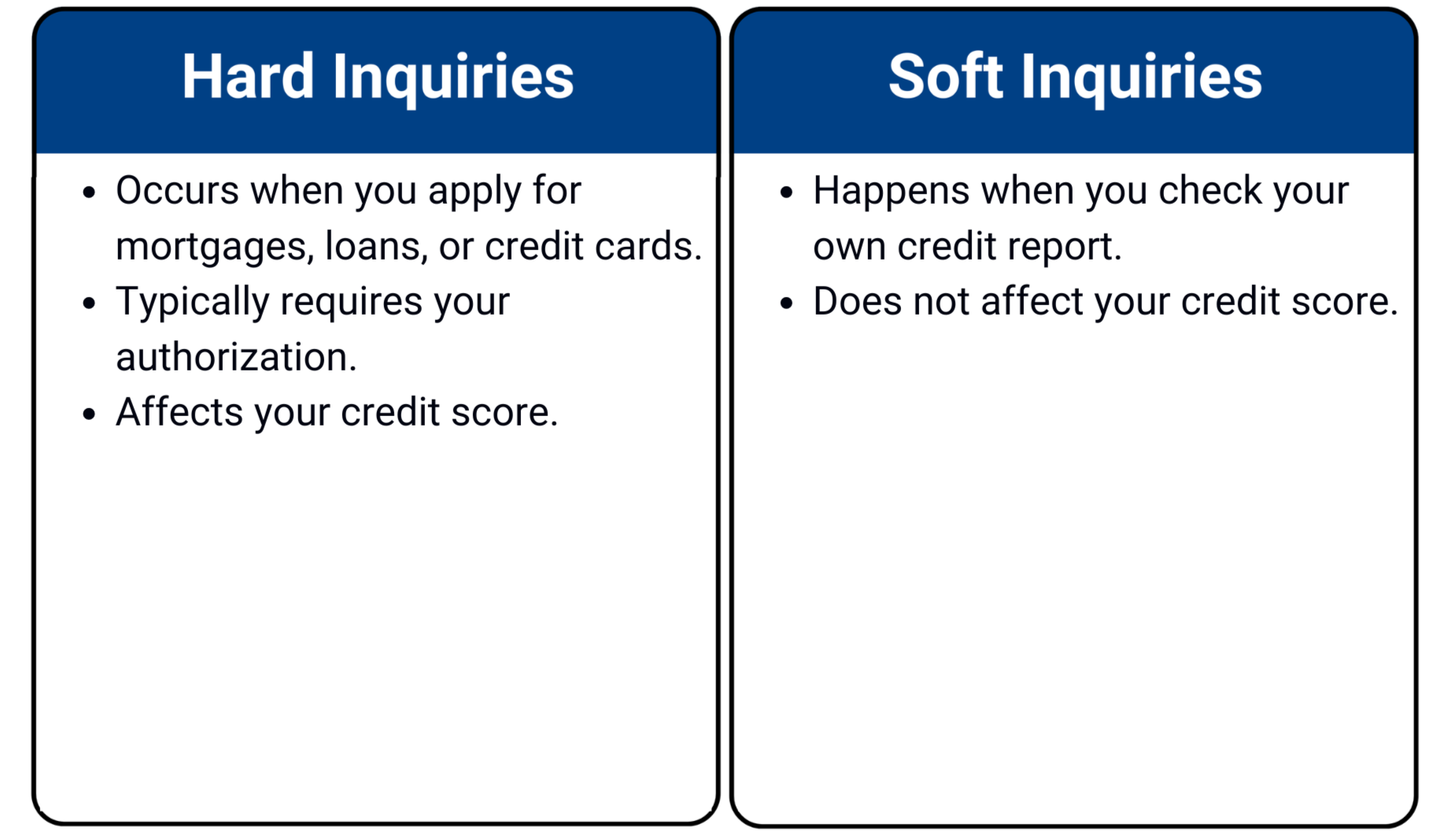

Hard Credit Inquiries

A hard credit inquiry happens when you apply for a new credit product, such as a mortgage, loan, or credit card. These inquiries may affect your credit score and usually require your authorization.

Soft Credit Inquiries

A soft credit inquiry occurs when you check your own credit report or when a third party checks your credit for informational purposes. These inquiries usually do not affect your credit score.

Differences Between Hard and Soft Inquiries

There is a common misconception that checking your own credit report can negatively impact your credit score. In reality, checking your own credit report only results in a soft inquiry, so there is no need to worry. Regularly reviewing your credit report is a smart habit. It helps you manage your credit health, spot any unauthorized hard inquiries, and promptly address potential identity theft.

Tips for Maintaining Good Credit Health

Maintaining good credit health is crucial for your financial well-being. Here are some tips:

- Avoid applying for multiple credit cards in a short time, as this can significantly lower your credit scores.

- Focus on building your credit before applying for new credit to improve your chances of approval and secure better terms.

- Regularly review your credit report to stay informed about your credit status.

Download CBM+ today to purchase your MySCoRE report to monitor your credit status and manage your financial health more effectively. By staying informed and proactive, you can make smarter credit decisions and build a stronger financial future.